Paying off your credit card monthly will increase your credit score and build trust with your lenders. CCCU is here to make managing your credit cards easier by answering questions on how to read your credit report, providing tips on managing credit cards, soft credit inquiries vs. hard inquiries, and more.

If you have a credit card or are thinking about getting one to build credit, you might be wondering if you should pay off your balance every month. Similarly, there are a number of ways to pay off your credit card (or credit cards) that will help you boost your credit and to minimize accrued interest. While there’s more than one way to pay your bills and manage your debt, certain strategies for paying off what you owe will help you in the long run.

How to read your credit report

Before we dive into the best ways to pay off your credit cards, let’s discuss how to read your credit report and evaluate your credit score. You can see both your credit report and credit rating from several online sources like Credit Karma, NerdWallet, and myFico as well as each of the three credit bureaus such as Equifax, Experian, and TransUnion.

When you get your credit report, you receive a detailed summary of your current and previous loans, credit accounts, and other debts, as well as hard inquiries, public records, bankruptcies, and collections. It will also show your current debt, available credit, and any closed accounts you may have. Your credit score is based around those factors as well as your payment and debt history.

Soft Inquiries vs. Hard Inquiries

Despite popular misconception, you can view your credit score and credit report as often as you’d like without impacting your credit health. Additionally, when your credit is reviewed for a background check for a job or to lease an apartment, it is considered a soft inquiry and will not impact your rating. Hard inquiries from lenders (such as those from credit card or mortgage companies) carry more weight and can affect your credit. However, if you only have two or three hard inquiries a year, they might only have negligible effects on your credit rating.

What is a credit score?

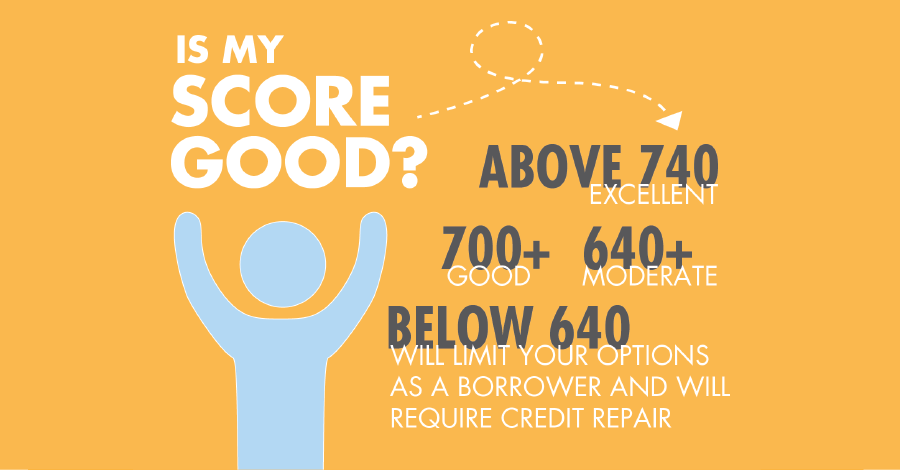

Your credit score is a crucial number you should keep a close eye on. It offers a quick snapshot of your current credit health and helps lenders make decisions on whether or not to approve a loan to a client. A credit rating is a designated set of numbers that range from 300 to 850, and is based on how well you managed debt in the past. Credit scores typically fall into the following ranges:- 800 - 850 is an exceptional credit score

- 740 - 800 is a very good credit score

- 670 - 749 is a good credit score

- 580 - 670 is a fair credit score

- 300 - 580 is an unsatisfactory credit score

How paying off credit balances each month improves your credit rating

Now that you know the basics of what a credit score means and how a credit report works, you might be wondering about the best ways to give your credit a boost. So, should you pay off your credit card each month? If you want to elevate your credit rating, we recommend paying your credit card balance in full if it’s possible. By paying your entire balance monthly and on time, you are showing creditors you are managing a line of credit responsibly.

Building credit takes time, but there are other ways to easily grow your score. One strategy is to use your credit card for recurring monthly payments (such as your phone or internet bill) and pay the amount off each month through automatic payments. By scheduling payments to process automatically, you will be able to easily boost your credit rating without putting in much effort.

What if you can’t pay off your credit card balance each month?

We know paying off a balance in full is easier said than done. If you’re unable to pay your credit card balance in full each month, try to keep your balance as low as possible. The general rule of thumb for a good credit score is that you shouldn’t have a balance of more than a third of your line of credit. If you do need to use a larger portion of your credit to make a purchase, it’s important that you attempt to repay the balance within a month or two.

If you’ve accrued substantial credit card debt or owe money on multiple cards, it could be a good idea to explore other payoff strategies. For example, one method is to prioritize paying off cards with the highest interest rates first. Another approach is to start by paying off your smallest debts. Your credit will likely see a slight uptick when each small account is paid in full, which might inspire tackle larger debts.

You might also be able to consolidate your credit card debt onto a single card at a lower interest rate. Doing this will not only allow you to save money on monthly interest, but it could help you manage your debt by only having to make one payment. When you finally get your credit card balance to zero, we recommend keeping the account open. When you close a credit account, it will negatively impact your credit by reducing the amount of credit you have available and the average age of your accounts.

Factors that impact your credit

Credit cards can be a highly useful tool for improving your credit health and managing your personal finances. However, they can be a slippery slope if you’re not comfortable using them or navigating interest rates. Here are a few things to keep in mind that could negatively impact your credit:

- Having lots of debt

- Making late loan payments

- Filing for bankruptcy

- Opening multiple new lines of credit

- Having several hard inquiries

The best way to increase your credit score is to pay off your credit card balance in full each month. Other than that, be sure to do your research, monitor your credit, and spend wisely. Have more questions about credit rating, debt management, consolidation or how to open a credit card at a Portland credit union? Contact Consolidated Community Credit Union today.

.png?width=800&height=1510&name=Credit%20Score-01(1).png)