Mobile Banking

Mobile Banking Benefits

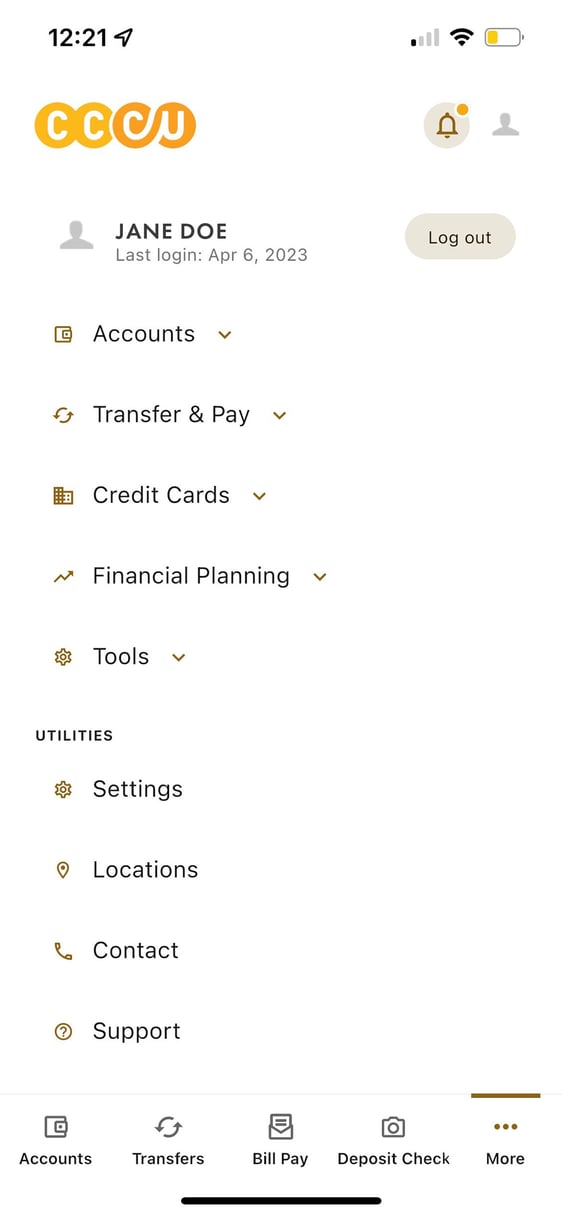

Take control of your personal or business finances anytime, anywhere, using the CCCU Mobile Banking app. It's a secure, intuitive, and feature-rich virtual banking experience, right within your mobile device!

Save Time

Aggregate Your Accounts

Bank Safely

External Link Disclosure

As a service to our members, the Credit Union will provide links to websites that are not operated by Consolidated Community Credit Union. We are providing these links to give our members access to the information we feel may be of interest to them or to assist them in transacting business with the Credit Union. If you elect to do business at a linked site, please be advised CCCU does not represent you or the linked site if you enter into a transaction unless that site is related directly to products or services offered by the credit union. You understand and agree that the Credit Union is not responsible for and exercises no control over these linked sites, nor have we verified the accuracy, privacy, or security of the information on these linked sites. You further understand and agree that the Credit Union is not liable for any damages, losses, or expenses that you may incur while using these linked sites. CCCU does not provide, and is not responsible for, the product, service, or overall website content available at a third-party site.

CCCU’s privacy policy does not apply to linked websites. Privacy and security policies may differ at this link site from those practiced by the credit union. Consult the privacy disclosures on the linked, third-party site for further information.

Mobile Banking Enrollment

To get started, watch the 2-minute video below, or follow these simple steps:

- Download the app, tap "register", and agree to the terms and conditions.

- Enter your personal info, including Account Number, SSN, and DOB.

- Pick a username, then follow the steps to login using a temporary password.

- Once logged in, choose a strong password, confirm your info, and you're set!

Don't forget to enable Face ID for secure access.

More Mobile Banking Tools

-

Bill Pay

Read MoreManage all of your bills and set up one-time or recurring payments to streamline your finances. Learn more by reading the FAQs on our online banking page.

-

Zelle®

Read MoreSend money to friends and family quickly and securely, even if they bank somewhere else. For more details, tap the arrow.

*Not eligible for business or youth accounts.

External Link Disclosure

As a service to our members, the Credit Union will provide links to websites that are not operated by Consolidated Community Credit Union. We are providing these links to give our members access to the information we feel may be of interest to them or to assist them in transacting business with the Credit Union. If you elect to do business at a linked site, please be advised CCCU does not represent you or the linked site if you enter into a transaction unless that site is related directly to products or services offered by the credit union. You understand and agree that the Credit Union is not responsible for and exercises no control over these linked sites, nor have we verified the accuracy, privacy, or security of the information on these linked sites. You further understand and agree that the Credit Union is not liable for any damages, losses, or expenses that you may incur while using these linked sites. CCCU does not provide, and is not responsible for, the product, service, or overall website content available at a third-party site.

CCCU’s privacy policy does not apply to linked websites. Privacy and security policies may differ at this link site from those practiced by the credit union. Consult the privacy disclosures on the linked, third-party site for further information.

Mobile Check Deposit

1. Open Your App

2. Deposit Check

3. Endorse the Back

4. Follow Prompts

Digital Wallet Tips

Make fast, easy, secure purchases in apps or anywhere contactless payments are accepted without even reaching for your wallet. Just store your CCCU Debit and Credit Cards in your Mobile Wallet.

- Setup is simple: Open your mobile wallet app, and add your CCCU debit and credit cards.

- Payments are easy: Make purchases in a flash wherever Apple Pay®, Google Pay™, or Samsung Pay® are accepted.

- Digital wallets are secure: Your card information isn't stored on your mobile device, and no card number is sent to the store.

Need some assistance? We're happy to walk you through it.

Related articles on personal finances

Enjoy browsing our collection of recent articles relating to identity theft, cyber security, and more.

Frequently Asked Questions

How do I start using the CCCU mobile banking app?

To get started, follow these simple steps:

- Download the app (search "Consolidated Community Credit Union" in your app store).

- Tap "register", and agree to the terms and conditions.

- Enter your personal info, including Account Number, SSN, and DOB.

- Pick a username, then follow the steps to login using a temporary password.

- Once logged in, choose a strong password, confirm your info, and you're set!

Don't forget to enable Face ID for secure access.

I forgot my password. How do I reset it?

To reset your password or unlock your Online Banking profile, click the “Login” button in the upper right on any page of our website.

- Click “Forgot password/username”.

- From here you can have your user ID sent to you and reset your password.

If you discover you’d been “locked” out of your account, please call our Member Contact Center at 800.444.8115 or visit a branch.

What will mobile deposit cost me?

Mobile deposit for personal accounts is FREE of charge up to 150 check deposits per month.

Mobile deposit for business accounts is FREE up to 150 check deposits per month, and a charge of $0.45 for each check over 150.

Do I need to endorse my checks?

Yes, checks should always be endorsed. For added security, please write "For Mobile Deposit Only at CCCU" beneath the endorsement field.

What can I deposit electronically?

You can deposit checks written to you that will draw from an account at a financial institution within the United States through mobile deposit. Here are some examples of unacceptable checks:

- Savings bonds

- Foreign checks

- Checks or item payable to any person or entity other than you

- Photocopies of checks

- Items stamped "non-negotiable"

- Incomplete checks

- State-dated or post-dated checks

- Checks that contain evidence of alteration of information on the check

- Checks that have been previously submitted for deposit

When will my deposited check show up in my account?

Your check will be deposited in real-time, so you will see money in your account immediately after the check is deposited!

Does CCCU have Zelle®?

Yes! You can send money to friends and family using Zelle®. The convenient Pay-to-Person payment service is available for free to CCCU members in Online Banking and the mobile app. Here’s how to enroll.

- Log in and select “Transfer & Pay," then "Zelle®,” and follow the verification steps.

- Enroll your U.S. mobile number or email address.

- You’re ready to start sending and receiving money with Zelle®.

Tip: Since money is sent directly from CCCU account to another person’s bank account within minutes, Zelle® should only be used to send money to people you trust.

As of March 31, 2025, all users must be enrolled through one of the more than 2,200 banks and credit unions that offer Zelle® in order to send and receive money. You can find a full list of participating banks and credit unions live with Zelle® at Zellepay.com. If their bank or credit union is not listed, we recommend you use another payment method at this time.

To send or receive money with Zelle®, both parties must have an eligible checking or savings account.

Business and Youth accounts are not eligible to use Zelle®.

Can I transfer money to another CCCU member?

Yes, you can transfer money to another member!

Conduct both internal and external transfers through Online Banking or the Mobile Banking app.

Internal Transfers

- Log in and select “Transfer & Pay", then “Transfer”.

- Fill in the required information. You can transfer simply by using the other member’s first and last name, and account number.

- Once you have completed all of the fields, click “Review transfer”.

External Transfers

- Log in and select “Transfer & Pay", then “Transfer”.

- Select “from account” and “to account” you wish to transfer, then fill in the other required information. (If you have not already linked the desired external account within online banking, follow these steps to link, then you’ll be able to conduct external transfers to that account.)

- Once you have completed all of the fields, click “Review transfer”.

Tip: If you’re unsure about how much you can transfer, scroll to the bottom of the screen and where it says Learn more about our Transfer Policy and Limits, select “Limits”.

What do I do with the check once I've deposited it with mobile or express deposit?

We recommend keeping the check in a safe place for 60 days after deposit confirmation.

Why did I receive a popup notification of an issue with my submission?

These popups are called 'actionable alerts'. They alert you to potential errors or issues on the check you are trying to deposit. Most alerts will have a "submit anyway" option that you can select to proceed. Some issues may not offer a "submit anyway" button, but will allow you to "Try again" or "Cancel".

How do I take a good photo of my check to ensure it will be successfully submitted?

One of the most common reasons checks are denied is because of poor photo quality. Here are some tips to ensure your check is submitted correctly every time:

- Hold camera parallel above check (not at an angle)

- Take photo in good light, but do not use flash

- Take photo on a solid, dark background

- Make sure your check is flat with no folds

DISCLOSURES

The CCCU Mobile App and services provided within do not have a fee. Based on your wireless plan and mobile carrier's offering, additional message data charges and foreign transaction fees may apply. View our Online Banking disclosure. Mobile Deposit restrictions may apply.

App Store is a service mark of Apple Inc. Google and Google Play logo are trademarks of Google Inc. Samsung Pay® is a registered trademark of Samsung Electronics Co., Ltd. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Other company and product names mentioned may be trademarks of their respective owners.