CCCU Benefits

Shaping Our Future Together in 2025

Embracing New Opportunities

Since 1954, we have been dedicated to the well-being of our employees and their loved ones. Our commitment to continuously enhancing your benefits reflects our belief in empowering you to prioritize your health, overall well-being, and future. We know that by doing so, you’re better equipped to embrace our mission of delivering an outstanding banking experience to all members of our community.

We’re excited to offer you and your loved ones choices; please carefully review each plans details – including premiums and how much you pay for care.

New Hire Enrollment

At CCCU, we believe in taking care of our own, and that’s why we offer a comprehensive benefits package designed to support your health, well-being, and financial future. Our package includes medical, vision, dental, disability, life, and AD&D coverage, as well as a retirement plan that lets you choose between pre-tax and Roth 401(k) contributions. To give your financial future an extra boost, we make substantial contributions to pre-tax 401(k).

You’ll be eligible to enroll in our plans starting on the first day of the month following your hire date. Our knowledgeable human resources team will reach out to guide you through the details of these plans and help you get enrolled as you approach your 30-day milestone.

For our 401(k), eligibility starts after 6 months. Restrictions apply.

We’re here to help you build a strong financial foundation for the future. We can’t wait to see you thrive as part of our team!

Benefits Eligibility

You are eligible to enroll for benefits if you are a full-time employee who is regularly scheduled to work 30 or more hours per week.

Dependent Eligibility

If you are eligible to elect coverage for yourself, you may also elect coverage for your eligible dependents. Your eligible dependents include:

• Your legal spouse or registered domestic partner.

• Your children up to age 26 (25 years old or younger) - including biological children, stepchildren, adopted children, children whose legal guardianship has been granted to you by the state.

• Your unmarried child age 26 and older who depends solely on you for your support because of a mental or physical disability where the disability arose before age 26 (documentation is required).

Plan Documents: This website provides a highlight of your benefits. If any statement on this website conflicts with any applicable plan documents, the plan documents will govern. Plan provisions may be changed or deleted in order to meet any state or legal requirements. CCCU reserves the right to amend or terminate benefits as it deems necessary at any time. Failure to complete eligibility and other required documents may make employees ineligible for benefits coverage.

Meet Nayya

Nayya is a personalized decision tool that tailors your benefit options to your unique needs, simplifying the process of comparing different health plans and their costs. With Nayya, you can confidently select the coverage that best suits you and your family. The process is quick and easy—employees complete a 5-10 minute survey that gathers your preferences and creates a custom benefit plan to guide your choices.

To enroll, click below and select "create an account" and enter your personal email address.

(If your personal email does not work, please use your CCCU email.)

Insurance Plans

Regence 1000

A plan with a lower annual deductible, but has higher monthly premiums.

New for 2025:

The Regence 1000 plan will no longer receive employer funding in the Health Reimbursement Account (HRA). See HRA for more information.

Regence 3000

A plan with lower monthly premiums and a higher annual deductible.

New for 2025:

Out-of-pocket max is $7,150 for Employee only, $14,300 with Dependents.

Regence 5000 HSA (HDHP)

* New for 2025! *

A High Deductible Health Plan (HDHP) option has lower monthly premiums but higher upfront costs before coverage kicks in. A Health Savings Account (HSA) with an employer contribution is paired with this plan to help cover out-of-pocket costs.

$5,000 Deductible, Employee Only

$10,000 with Dependents

You’ll receive your member ID card in the mail. It will come in a plain envelope, so don’t throw it away! Have it handy and create an account at Regence.com or on the Regence app. This will allow you to easily access all the tools and resources that come with your membership.

Who can provide me with Healthcare?

Choosing in-network providers and pharmacies is a great way to lower out-of-pocket expenses. Out-of-network providers do not have agreed upon pricing with Regence. Wherever you decide to receive care, requesting an estimate prior to services makes good financial sense.

Get the Regence App!

For added convenience, download the

app for your iPhone or Android.

Need a Provider?

Check out the directory of participating healthcare providers within the Regence network.

Understanding Health Insurance

Need help understanding health insurance? We'll start at the beginning.

Learn everything you need to know about health insurance - including terminology, how insurance works, who pays what, and the importance of networks.

Which Care Options Fit My Needs?

Nurse Line

Consider for: Cold & flu, fever, minor burns and injuries.

Availability: 24/7

Avg. Cost: None

Avg. Wait Time: Short

Virtual Visit

Consider for: Allergies, anxiety & depression, cold & flu, UTIs.

Availability: 24/7

Avg. Cost: Low

Avg. Wait Time: Short

Urgent Care Clinic

Consider for: Abdominal pain, migraines, sprains, strains & cuts.

Availability: Vary

Avg. Cost: Moderate

Avg. Wait Time: Moderate

In-Home Urgent Medical Care

plan and where you live.

Consider for: Cuts & lacerations, infections, nausea & vomiting, sprains & strains.

Availability: Vary

Avg. Cost: Moderate

Avg. Wait Time: Moderate

Emergency Room

Consider for: Chest pain, major burns & injuries, shortness of breath, uncontrolled bleeding.

Availability: High

Avg. Cost: High

Avg. Wait Time: Long

Regence Plan Benefits

What I Pay

Physician Provider Services

*(In-Network Only) First 3 Primary Care, Behavioral Health and Virtual Care visits combined, $5 copay per visit, deductible waived. After 3 visits, $30 copay per visit, deductible waived. Not applicable for Out-Of-Network Services.

*(In-Network Only) First 3 Primary Care, Behavioral Health and Virtual Care visits combined, $5 copay per visit, deductible waived. After 3 visits, $30 copay per visit, deductible waived. Not applicable for Out-Of-Network Services.

Alternative Care

Acupuncture

In-Network

$30/Visit

Out-of-Network

$30/Visit

Regence 5000 HSA (HDHP):

20% After Deductible

Limit 30 visits/year

Chiropractic

In-Network

$30/Visit

Out-of-Network

$30/Visit

Regence 5000 HSA (HDHP):

20% After Deductible

Limit 30 visits/year

Alternative Care

In-Network

$30/Visit

Out-of-Network

40% Coinsurance

Regence 5000 HSA (HDHP):

20% After Deductible

Naturopath

Pro Tip: Get Insurance to Cover Your Massage Therapy

Did you know your Regence health plan may cover therapeutic massage? Follow these steps to ensure your massage is covered under your plan:

- Find an In-Network Provider

- Go to regence.com and search for a Licensed Massage Therapist (LMT) in your network.

- Contact the therapist to confirm they are in Regence's network of providers.

- Schedule for a Medical Condition

- Insurance does not cover massages for stress or relaxation. Be prepared to discuss a medical condition that justifies the massage therapy.

- Insurance does not cover massages for stress or relaxation. Be prepared to discuss a medical condition that justifies the massage therapy.

- Provide Your Insurance Card

- Although pre-authorization is not required, ask the LMT to call Regence to confirm coverage before your appointment. This ensures the massage will qualify for your plan’s benefits.

- Although pre-authorization is not required, ask the LMT to call Regence to confirm coverage before your appointment. This ensures the massage will qualify for your plan’s benefits.

- Request Pre-Authorization

- Know Your Plan Details

- Regence 1000 or 3000 Plans: You'll pay a $30 copay for a covered massage.

-

- Regence 5000 Plan: Costs apply toward your deductible and out-of-pocket maximum.

Taking these steps can save you time, stress, and unexpected costs. Enjoy the benefits of massage therapy while keeping your coverage in check!

Emergency, Urgent Services, Hospital Services

Emergency

In-Network

$150

Out-of-Network

$150

Regence 5000 HSA (HDHP):

20% After Deductible

Urgent Services

In-Network

$30/Visit

Out-of-Network

40% Coinsurance

Regence 5000 HSA (HDHP):

20% After Deductible

Inpatient

In-Network

20% Coinsurance

Out-of-Network

40% Coinsurance

Regence 5000 HSA (HDHP):

20% After Deductible

Pregnancy Program

Get pregnancy and new-parent support with

our Pregnancy Program. Your maternity nurse

care manager can answer all your questions,

plus, the program includes its own app to track

milestones during pregnancy and baby’s first

year.

Supporting Your Journey

As a Regence member, you can save between 10% and 40% on fertility services, including IUI and IVF treatments, genetic testing services and fertility medications.

WINFertility

WIN makes fertility treatment affordable. For nearly 20 years, WINFertility has been linking infertile families with reasonably priced, conveniently located, proven fertility specialists who can help. A key to our success is offering Treatment Bundles that reduce the total cost of fertility treatment. WINFertility Comprehensive Treatment Bundles℠ include the medical services, genetic testing and medications you need to help you have a baby. If a fertility specialist is already treating you, the WINFertilityRx Program can help you save up to 40% on fertility-specific drugs.

- Save between 10% and 40% on your fertility services, including IUI and IVF treatments, genetic testing services and fertility medications.

- No clinical or age criteria required. No fees to enroll.

- You pay a single payment to WINFertility, and WIN handles all payments to providers, genetic testing laboratories and pharmacies for your treatment. Or, WINFertility treatment financing options are available to allow you to pay overtime.

- Treatment bundles contain a comprehensive package of all medical services and the medications you need to help you have a baby.

- WINFertilityRx program is also available with savings up to 40% on fertility-specific pharmaceuticals for those who have a fertility specialist not within the WINFertility network

- A free consultation with a friendly Nurse Care Manager is available.

Our free prenatal program (for anyone enrolled) helps prevent birth defects. It includes a supply of folic acid

Behavioral Health Support

Many therapists and psychiatrists offer both in-person and virtual appointments, so you can get care just how you need it. It can be challenging to find a mental health provider that is right for you. On top of that, wait times can be long. Regence is here to help you find someone who can see you soon – just chat with us online at Regence.com or call us at 1(888) 367-2116.

Employees also get free virtual counseling through Talk Space.

Doctor On Demand

Visit a doctor or therapist via video chat. We all have times when we need to see a doctor, but it’s inconvenient – there’s no time, the office is closed, or we’re on the road. You know that feeling. “I need to make an appointment, but I don’t want to take time off of work.” Now you can. Your new plans include telehealth powered by Doctor on Demand, a national leader in quality care. You can talk to any of Doctor On Demand’s Board Certified Physicians, Licensed Counselors and Psychiatrists by video chat using your computer or the app – 7 days a week, 365 days a year.

24/7 Nurse Line

can advise you on common issues, such as:

• Vomiting & nausea

• Cuts & minor burns

• Viruses, coughing, dizziness & headaches

• Back pain

• Feverish baby

What you can expect:

• Ask about your symptoms

• Direct you to an emergency room or urgent care when advisable

• Help you decide if you should see a doctor

• Provide self-care suggestions for minor injuries and illnesses

• Help you prepare for a doctor visit

• Help you understand your prescription

To contact the nurse line, call (800) 267-6729

Regence Care Management

The mission of care management is to prioritize the needs of their members by providing personalized, equitable services that enhance their wellbeing.

• Advocating for members and their support systems

• Improving care through close collaboration with providers

• Supporting members transitioning to different levels of care

• Assisting members as they navigate the health care system

• Educating members about their care options, benefits and coverage

• Supplementing information given by providers to help members make educated decisions regarding their health care

Contact the Regence Care Management team

by calling 1(866) 543-5765

Reward Program - Regence Empower

Whether you want to start a new fitness routine, improve your sleep habits or practice mindfulness, there is a program for you. Working on your health is more fun together,

so your spouse or partner can earn the same incentives as you do!

Get going today! Begin your well-being journey by taking the online Regence Empower Health Assessments. Then, throughout the year, you’ll have opportunities to earn rewards while building positive habits for your health.

GET REWARDS FOR BEING PROACTIVE:

You can earn up to $100 per year in gift cards for engaging in healthy activities that support your long-term health, like getting preventative exams and screenings. Your Regence health plan covers preventative care at no cost to you when you see an in-network provider.

READY TO GET STARTED

regence.com and select Regence Empower to start your well-being journey today.

Step 2: Download the app. You live life on the go. Keep your well-being journey at your fingertips by downloading the Regence Empower App.

Step 3: Engage today! Complete your Health Assessment, schedule your wellness exam and any necessary screenings, participate in challenges, track health activities and more.

Health Assessment

Preventative Wellness Exam

Breast & Cervical Cancer Screenings

Colorectal Cancer Screening

Vision Exam

Dental Visit

Health Tech

Health Learning Activities

Employee Assistance Program (EAP)

COUNSELING

Confidential Counseling: Up to four counseling sessions for relationship issues, anxiety, work stress or other challenges, available in person or over the phone, video or chat; schedule online or by calling the toll-free line.

24/7 Crisis Help & Referral: Master's-level behavioral health clinicians available around the clock and in multiple languages to provide crisis help, assess your needs and refer you to an in-network provider or other resources.

Online Communities: Topic-based support forums for individuals struggling with similar issues, such as grief and loss, life balance and resiliency, family conflicts and more.

LEGAL/FINANCIAL

Legal Help: Consultations over the phone with in-house attorneys for help with family law, identity theft, custody, real estate and more, plus local referrals to in-person consultations and a 25% discount on legal fees.

Financial Guidance

Consultations over the phone with in-house financial experts for help with budgeting, debt counseling, improving credit, saving for college, retirement/estate planning, taxes and more.

FAMILY

Child Care: Support finding local resources for parenting, adoption, education/college planning, teenager challenges, day care and other issues for parents.

Adult & Elder Care: Specialists who help find information on transportation, meals, exercise programs, activities, in-home care, daytime care, housing and more.

ANYTIME ACCESS TO THE EAP

You can access all your EAP resources through an easy-to-use website and app, where you can explore on-demand trainings and articles on wellness, relationships, work, educations, legal help, financial guidance and much more.

To Get Started:

- Go to guidanceresources.com download the GuidanceNowTM App.

- Select Register and then enter your Organization Web ID: EAPO

- After entering this one-time code, you'll create your own username and password to access your resources anytime.

EAP - Additional Guides & Information

Prescription Options

Tier 1

- $5 retail

- $15 home delivery

- $10 for each self-administrable Cancer Chemotherapy medication

Regence 5000 HSA (HDHP):

20% After Deductible

Tier 2

- $20 retail

- $60 home delivery

- $10 for each self-administrable Cancer Chemotherapy medication

Regence 5000 HSA (HDHP):

20% After Deductible

Tier 3

- $25 retail

- $75 home delivery

- $50 for each self-administrable Cancer Chemotherapy medication

Regence 5000 HSA (HDHP):

20% After Deductible

Tier 4

- $50 retail

- $150 home delivery

- $50 for each self-administrable Cancer Chemotherapy medication

Regence 5000 HSA (HDHP):

20% After Deductible

Tier 5

- 30-Day Supply: $150 participating pharmacy retail

- $100 for each self-administrable Cancer Chemotherapy medication

Regence 5000 HSA (HDHP):

20% After Deductible, 30-Day Only

Must Use the Following Pharmacy:

Accredo Specialty Pharmacy

P: 877.882.3324

Tier 6

- 30-Day Supply: 50% participating pharmacy retail

- $100 for each self-administrable Cancer Chemotherapy medication

Regence 5000 HSA (HDHP):

50% After Deductible, Specialty Drugs

Must Use the Following Pharmacy:

Accredo Specialty Pharmacy

P: 877.882.3324

Six Tier Drug List

Regence BCBS - Additional Guides & Information

Vision & Dental Benefits

To access vision and dental benefits, when promoted, please enter the same password you entered for this benefits site.

Dental Benefits

Health Reimbursement Account (HRA)

Important Update: Health Reimbursement Account (HRA)

The Health Reimbursement Account (HRA) will be discontinued effective December 31, 2025. This decision was made after careful consideration and in response to employee feedback regarding a desire for a wider variety of coverage options.

HRA Fund Usage:

- For the Regence 1000 Plan: If you enroll in this plan in 2025, you may continue to use any remaining funds in your HRA until the end of the plan year. Please note that CCCU will no longer make contributions to this account in 2025.

- For the Regence 5000 HSA (HDHP) Plan: If you are currently enrolled in the Regence 1000 plan and choose the Regence 5000 HSA (HDHP) in 2025, any remaining HRA funds must be spent by December 31, 2024, or they will be forfeited.

Health Savings Account (HSA)

New for 2025, CCCU is adding a Health Savings Account (HSA) with employer funding for employees enrolled in the Regence 5000 HSA (HDHP).

An HSA is tax-advantaged savings account that allows you to set aside money for medical expenses if you have a High Deductible Health Plan (HDHP). Contributions are made with pre-tax dollars, reducing your taxable income, and the funds grow tax-free. You can use the money for various healthcare costs, and any unspent funds roll over each year, making it a flexible way to save for current and future medical expenses.

- Catch-Up Contribution for Age 55+: An additional $1,000

- Plans are portable. You may take them with you, if you were to leave the credit union.

- Funds over $2000 can be invested.

- Funding, interest and withdrawals for eligible expenses are all tax free. This is a great way to save for future medical expenses.

HSA Employer Monthly Funding

Employee Funding

-

Tax Free Employee Only $3400 - the employer contribution. Total cannot exceed $3400

-

Tax Free Employee + Dependents $8300 – the employer contribution. Total cannot exceed $8300

Limited Purpose Savings Account

New for 2025, employees may choose to enroll in a Limited Purpose Savings Account if enrolled in Regence 5000 HSA (HDHP) up to $3200 to assist with pretax dental and vision expenses.

If you are an employee with a healthcare flexible spending account (FSA) and enrolling in the Regence 5000 HSA (HDHP) in 2025, you may either spend down your FSA no later than 12.31.24 or you may roll over up to $660 into a Limited Purpose Savings Account (LPFSA)

HSA & Limited Purpose Savings Account - Additional Guides & Information

Flexible Spending Accounts (FSA)

A tax-advantage FSA is a great way to save money with pre-tax dollars to reimburse yourself for a wide variety of IRS-eligible health and/or dependent care expenses that are not covered through your other benefit plans. The annual amount you elect to contribute to each account will be divided into equal amounts and deducted from your paycheck pretax, therefore reducing your taxable income.

We Offer the Following FSAs

Healthcare FSA

• Pay for eligible health care expenses, such as deductibles, copays, and coinsurance. To learn more, visit Irs.gov and search for publication 502 or visit healthequity.com. To purchase eligible healthcare products, visit Fsastore.com.

• Contribute up to $3,300 (Amount will be based on the 2025 IRS limit).

• All funds must be used within the plan year or the funds are forfeited, except for a limit of $660 which may be carried over from 2025 into the 2026 plan year.

Dependent Care FSA

• Pay for eligible dependent care expenses, such as daycare for a child, so you and/or your spouse can work, look for work, or attend school full time. To learn more, visit Irs.gov and search for publication 503 or visit healthequity.com.

• Dependent Care FSA contributions for 2025 are $5,000 for single filers and married filing jointly, and $2,500 for those who are married and filing separately.

How can you spend your money?

HealthEquity – Roll over amount for Healthcare Flexible Spending Account and new Limited Purpose Spending Account remains at $660 to roll over into 2025.

Healthcare FSA & HSA

• Medical and prescription copays

• Eligible over-the-counter medications and products

• Braces

• Contact Lenses

If an employee has funds in a healthcare FSA either with the 1000 or 3000 plan, they can roll up to $660 into a limited purpose FSA if they are moving to the high deductible plan in 2025.

Dependent Care FSA

FSA - Additional Guides & Information

Flexible Benefits & Medical Plan Compatibility

Medical Leave & Supplemental Insurance

OREGON PAID LEAVE

Paid Leave Oregon (PFML) is a program that provides eligible employees with up to 12 weeks of job protection, benefit continuation, and wage replacement while on leave for a qualifying family or medical reason. If you’re requesting leave for a pregnancy-related condition, you may qualify for up to 14 weeks of leave. Eligibility and benefits are determined by Standard Insurance.

WASHINGTON PAID FAMILY MEDICAL LEAVE

WA Paid Leave is a program that provides eligible employees up to 12 weeks of job protection, benefit continuation, and wage replacement while on leave per year for qualifying family or medical reason. It’s possible for you to receive 16-18 weeks of combined medical and family leave in certain circumstances. Eligibility and benefits are determined by the State of Washington.

Short- and Long-Term Disability

Short-Term Disability benefits are provided to help offset loss of income that results from an accidental injury or illness. Coverage begins on the 8th day after an illness or injury and pays you 66 2/3% of your weekly earnings. Benefits are payable for up to 12 weeks. If your disability lasts longer than 90 days, our Long-Term Disability plan provides a source of income to protect you and your family for an extended period of time.

Aflac

Plans are changing from individual plans to a group plan. Employees will be able to port existing plans if they choose. If done, employees will be responsible for monthly payment directly to AFLAC, as payroll deductions will only accure for group plan elections.

Accident

Accident insurance supplements your medical plan by offsetting out-of-pocket medical expenses or other expenses arising from a covered accident.

Critical Illness (Specified Health Event)

A lump-sum benefit is payable if you are diagnosed with a covered critical illness. The cash benefit can be used as you see fit.

Hospital Confinement

Hospital stays are expensive. The Hospital Confinement Insurance Policy can help ease the financial burden of hospital stays by providing cash benefits.

2025 Aflac Elect Coverage

Critical Illness Coverage

Aflac - Additional Guides & Information

Supplemental Life & AD&D

CCCU is transitioning from Standard to Guardian for all life, ad&d and disability. For more information on maintaining your Standard life and/or ad&d plans, please reach out to human resources for portability resources.

- Basic Life and AD&D

- 1x Annual Salary minimum of $50k, up to $200k

You can buy more protection

Optional Life and AD&D Insurance with Guardian. You can buy additional Life and/or AD&D coverage for yourself, your spouse/partner and your eligible children*.

Voluntary Life and AD&D

These are separate plans and need to be selected as such for voluntary coverage. Any amount over the guaranteed issue amount, employee or spouse must complete evidence of insurability. Click to view instructions on how to complete evidence of insurability.- Employee

- Up to $300k

- Guaranteed Issue - $150k

- $10k increments

- Spouse

- Up to $300

- Guaranteed Issue - $20k

- $10k increments

- Note: May select up to employee coverage amount, but not more.

- Child

- Up to $10k

- Guaranteed Issue - $10k

Leave of Absence Administration (LOA)

- Short-Term, Long-Term Disability and Paid Leave Oregon (PLO) Beginning 1.1.25

- All other Federal, State (OR, WA, CA, ID, AZ, OH) and ADA Administration begins Est. 3.1.25

Family Leave, Disability, AD&D and Aflac Additional Guides & Information

Paid Leave Oregon

Short- and Long-Term Disability

Life & AD&D

Retirement Plans

A 401(k) plan is an employer-sponsored retirement plan that is a great tool to help you save for a financially secure retirement through either pre-tax or after-tax contributions. You are eligible to participate in the plan if you are 21 years of age and after 6 months of employment.

The IRS limits the amount you can contribute to the plan. These limits may be adjusted by the IRS each year. The 2025 salary deferral limit will increase to $23,500. Participants over the age of 50 are eligible to make additional “catch-up” contributions of $7,500 beginning in the year they turn 50, bringing the total contribution limit to $31,000.

Participants can elect to make either pre-tax contributions (Traditional) or after-tax contributions (Roth). If you make pre-tax contributions, you do not pay federal or state income tax on the amount you contribute or on any earnings until you make withdrawals from the plan.

Pre-Tax Employer Contribution

New in 2025 - To support your retirement savings efforts, CCCU will contribute a flat 8% on all gross wages to your pre-tax 401k. You must be employed 6 months and be 21 years of age or older.

Vesting

In a retirement plan, vesting refers to ownership. Participants are always 100% vested in their own contributions to the plan. Employer contributions are fully vested after three years of vesting service. If you terminate employment before becoming fully vested, your non-vested employer contributions will be forfeited.

Enrollment

Prior to enrollment, you will attend an informational session and have access to one-on-one meetings with investment advisors through Principal Financial Group and OneDigital. Principal Financial Group will discuss their wide array of investment options and provide you with an overview of their website, where you can view and manage your account, make changes to your contribution elections, allocate funds in their various investment choices, and much more.

Secure Act 2.0 Employer Contribution

If you are interested in the Secure Act 2.0 Employer Contribution to a Roth Account, this is still not active, but we encourage you to reach out to Principal about a Roth conversion/transfer. This is something our plan allows and can be completed online under the contributions tab > last option "Roth Transfer".

401k Additional Guides & Information

2025 Business Plan

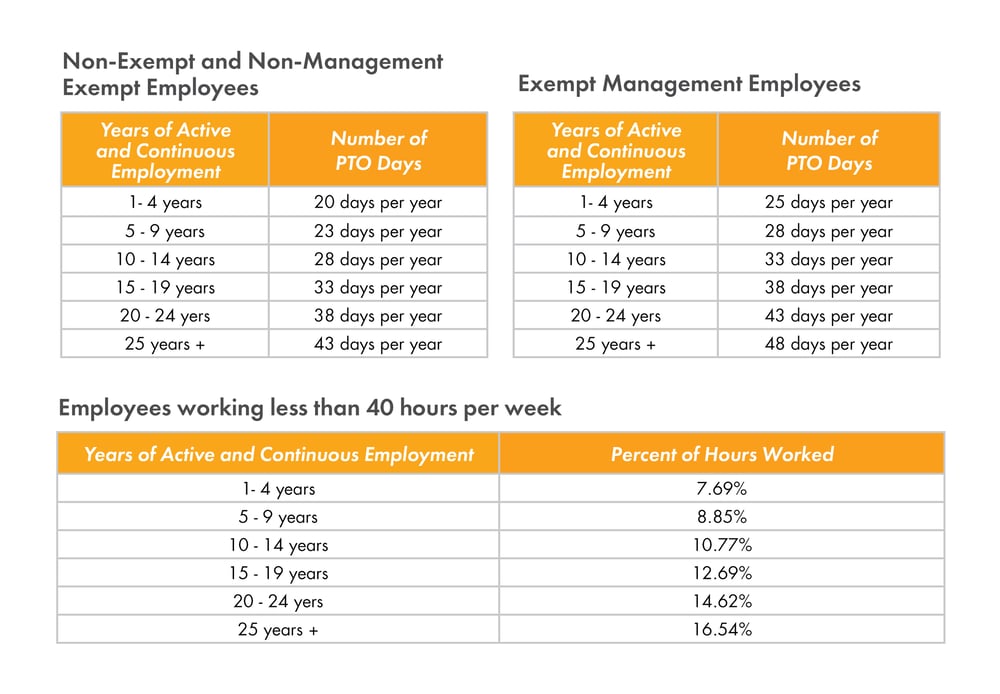

Paid Time Off

Celebrating YOU!

Reserve Sick Time

How does it work?

Holidays

All full-time employees are eligible for holiday pay beginning on their first day of employment. Part-time employees are eligible for holiday pay for the number of hours they are typically scheduled to work if the holiday falls on a day they are normally scheduled to work.

We recognize federal holidays observed by the Federal Reserve, unless the holiday falls on a Saturday or Sunday. When a holiday falls on a Saturday, we will observe the holiday on the Friday before. In the event that New Year’s Day is a Saturday, it will not be observed. Any holiday that falls on a Sunday will be observed on the following Monday.

Employees that celebrate a holiday not observed by the Federal Reserve may request to use PTO or unpaid time off for a holiday of a deeply held religious belief. For questions or accommodations, please contact a human resources representative.

Holiday Closures

Love Working at CCCU

We hope you enjoy working at CCCU as much as we love having you as a part of our team. Throughout the year, we enjoy “Love Where You Work” events to celebrate our employees and their achievements.

Select Employer Group Partner Perks

Enjoy employee store invitations and exclusive discounts from our SEG partners, Columbia Sportswear and adidas.

Length-of-Service Program

We offer service awards and year-end bonuses to employees based on their years of employment with us.

The chart below represents the amounts for full-time employees working 30 or more hours per week. Part-time employees are paid at 50% of these rates.

CCCU Philanthropy

Local and Regional Efforts

We are deeply committed to local and regional philanthropy focused on supporting housing empowerment, family wellness and the opportunity to thrive within society. As a not-for-profit credit union, we focus on making our communities stronger, healthier places to live, work and raise families.

Who we support:

• African American Alliance for Homeownership (AAAH)

• Columbia Gorge Community College

• Columbia Gorge Food Bank

• Credit Union for Kids (CU4Kids)

• Hacienda CDC

• Emerging Leaders PDX

• Exceed Enterprises

• Hood River Education Foundation

• Hood River FFA

• Hood River Grad Project

• Hood River Lions Club

• Living Room Realty

• Proud Ground

• Randall Children’s Hospital

• Mercy Corp

• Metropolitan Youth Symphony

• Oregon Humane Society

• The Next Door, Inc.

• University of Portland

• Urban League of Portland

• Young CU Professionals of PDX (YCUP)

• Youth, Rights & Justice (YRJ)

African American Alliance for Homeownership (AAAH)

How we support AAAH:

Attend AAAH housing fairs, host virtual homebuying seminars, and participate in their day of service (a volunteer event where we help with home repairs and yard maintenance for those in need).

Financial Empowerment Collaborative (FEC)

How we support FEC:

We partner with four other local credit unions to offer financial wellness through the Urban League of Portland. This includes seminars, events, and one on one financial counseling for those in need.

Credit Union for Kids (CU4Kids)

How we support CU4Kids:

All proceeds from our Swag Wall are donated to CU4Kids on behalf of Doernbecher Children’s Hospital. We also host a staff and member CU4Kids fundraiser each year.

Youth, Rights & Justice (YRJ)

How we support YRJ:

We are a Platinum Sponsor for the YRJ Gala.

Helping Hands

Our workplace giving program, encouraging employees to support our community.

Volunteer/donation day

Following 90 days of employment, each employee is eligible to take up to 8 hours of donation pay to volunteer with a charitable organization!

Limit to one day, up to 8 hours of donation pay per calendar year.

• Only non-profit organizations that have an IRS 501c status (and educational institutions)

• All volunteer hours must be pre-approved by your manager.

• Charitable organization must sign off request form after the time has been completed.

Sponsored Volunteer Days

We’re excited to offer employees the opportunity to participate in CCCU Sponsored Volunteer Days. These special events, organized in collaboration with our philanthropic partners, typically take place over the weekend. Employees who volunteer outside of their normal working hours will have their volunteer time offset during the regular work week. Opportunities will be emailed to employees as they become available throughout the year. We encourage you to join the fun!

Special Discounts Just for You

Perks at Work

Discount Vision Program

Active&Fit Direct

Regence Advantage

Walgreens Smart Savings Discount

• Vitamins and supplements

• Allergy, cold and pain relief

• Eye care, dental care and baby essentials

• And more!

Banfield Pet Hospital

Discounts with Working Advantage

We’re pleased to offer this exclusive discount program available to all employees. Sign up for Working Advantage online and receive a weekly email with featured discounts for a wide variety of brands, such as movie tickets, theme parks, hotels, rental cars, sporting events, and more.

Work Perks

Transit Reimbursement

Up to $75/month for public transportation expenses to and from work. Submit a reimbursement form and receipts to AP@consolidatedccu.com.

Educational Resources

Earn up to $250 per calendar year for approved expenses at an accredited school.

LinkedIn Learning

Interested in learning more? Please connect with your local library and speak with your manager about courses that will help you start building for tomorrow.

BAI

Ready to boost your leadership abilities? Dive into courses like ‘Project Management: The Basics’ or ‘Change Management – Coping with Change.’ Or, if enhancing your communication skills is your goal, explore ‘Telephone Techniques’ and ‘Optimizing Emails.’ At BAI, the world of learning is your fingertips.

Learn more at: Bai.org

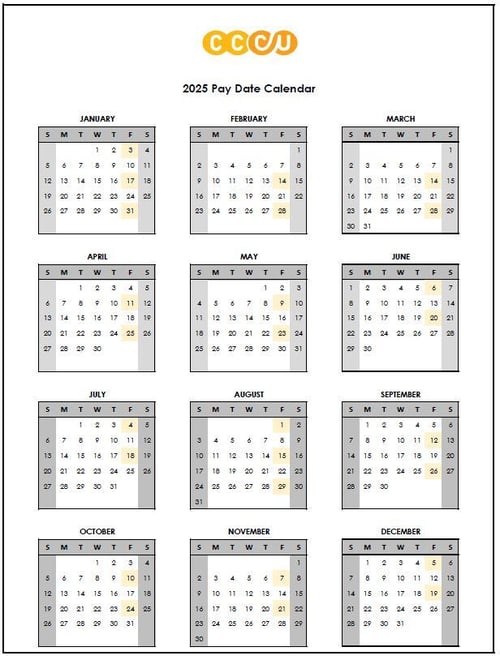

2025 Pay Date Calendar

Employees are paid on a bi-weekly basis, every other Friday.

HR & Benefit Vendor Contact Information

CCCU Human Resources

Kate Montgomery

HR Manager

602.750.5537

Leslie Wooden

HR/Admin Assistant

503.872.9448

Dental Insurance

Willamette Dental Group

T: 855.433.6825

W: willamettedental.com

Moda Delta Dental

T: 888.217.2365

E: customersupportOR@deltadentalor.com

AFLAC

Aflac District Manager

Joe Foxley

T: 907.982.7828

E: Joseph_Foxley@us.Aflac.com

Claims Administrator

Mary Baskin

T: 334.540.4001

E: mbaskin@communicorp.com